Why You Should Outsource Your Employee Benefit Plan RFP Process to an ERISA Independent Fiduciary

Did you know the US Department of Labor requires you to run a Request For Proposal (RFP) for service providers every 3-4 years?

There are two main reasons why the DOL wants an RFP for service providers to your employee benefit plan:

1) To ensure that the participants are receiving the proper services necessary for the plan

2) To ensure they are not paying more for those services than they should be (i.e., the fees paid to service providers must be “reasonable” under ERISA)

Keep reading to see why an ERISA Independent Fiduciary is the best person to carry out this task, and keep you legally compliant while doing so.

An ERISA Independent Fiduciary Provides You With:

I. Industry Knowledge

Because this isn’t an annual process, your team may not have the current knowledge of the employee benefit plan service provider marketplace, and which providers will be most likely to respond to your request.

II. Resources

Consider the time it takes:

- To gather a pool of service providers suited to your situation and perform the RFP screening interview prior to the RFP invitations going out

- To ensure relevant and updated topics are included in the RFP

- To run the process, establish scoring criteria, ask relevant questions, and distill the information into a robust recommendation

When you work with the ERISA Advisory Group, we provide written documentation of the process and why the recommendation is appropriate for the plan.

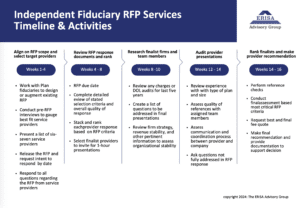

See our entire process for creating the RFP and our recommendation in detail below.

III. Experience

Gaining and maintaining industry knowledge, as well as developing a dialed in process, takes years of experience & practice.

At the ERISA Advisory Group, we have 25+ years of experience managing and running RFP Processes for plan sponsors and fiduciaries.

We’ve performed hundreds of RFPs for plan audits, health plan administration, 401k plan administration, investment providers, legal services, and health plan TPAs and networks.

It is also worth noting our President, William Kropkof, CEBS, served as a DOL Investigator tasked with enforcing Title I of ERISA for 7 years prior to starting his private practice in 1995.

So we know exactly what to look for when it comes to maintaining legal compliance in this area.

IV. Risk Reduction

By having an ERISA Fiduciary oversee the RFP Process and make the recommendation, the risk of DOL fines and penalties against plan fiduciaries is lessened.

In addition, the probability of a class action lawsuit will be greatly reduced by having an external, objective assessment that is not bound by past relationships and lack of knowledge of the current landscape of qualified, expert providers.

Get The RFP Process Done For You

We’d love to talk with you more about having the ERISA Advisory Group run and manage your RFP Process for your plan.

Please feel free to reach out to William Kropkof, CEBS:

Phone: 925.250.4030

Email: bill@erisaadvisorygroup.com

Alternatively, book a time in advance on the calendar below: